24 Prediction markets

Prediction markets are platforms where participants buy and sell contracts that pay out based on the outcome of future events. Contract prices are interpreted as market-implied probabilities. By harnessing the wisdom of crowds through market incentives, these markets offer a promising mechanism for improving forecasting. The evidence suggests they can often outperform traditional methods, particularly for well-defined questions where information is widely dispersed throughout an organization. This chapter examines prediction markets and their potential role in corporate decision making.

24.1 History and development

The concept of using markets to aggregate information about future events has a long history. As early as the 16th century, betting markets were used to predict political events in Italian city-states. More formalised prediction markets emerged in the late 19th and early 20th centuries, with election betting markets being particularly active in the United States until the 1940s.

The modern era of prediction markets began in the 1980s with the development of the Iowa Electronic Markets (IEM), created by the University of Iowa as a teaching and research tool. The IEM focused primarily on election outcomes and economic indicators, operating under a regulatory exemption from the U.S. Commodity Futures Trading Commission.

In the early 2000s, interest in prediction markets expanded with projects like:

- Hollywood Stock Exchange: A play-money market for predicting box office returns and award outcomes

- Intrade and Tradesports: Real-money markets covering politics, current events, and other outcomes

- DARPA’s Policy Analysis Market: A controversial (and ultimately cancelled) proposal for a market in geopolitical events.

The theoretical case for prediction markets was strengthened in 2008 when Arrow et al. (2008), including five Nobel laureates, published “The Promise of Prediction Markets” in Science, arguing for reduced regulatory barriers to these markets.

More recently established markets include:

Manifold Markets: A platform that allows users to create their own prediction markets on any topic.

Polymarket: A blockchain-based prediction market that allows betting with cryptocurrency.

24.2 How prediction markets work

The mechanics of prediction markets involve several key elements:

Contract definition: Wolfers and Zitzewitz (2004) describe three main types of contracts used in prediction markets:

- Winner-take-all contracts: These pay a fixed amount (typically $1) if a specific event occurs, and nothing otherwise. For binary questions (yes/no outcomes), the contract price directly represents the market-implied probability of the event occurring. These are the most common contract type in prediction markets.

- Index contracts: These contracts pay an amount that varies continuously based on a number that rises or falls, such as the percentage of the vote received by a candidate or a company’s sales figures. The price for such a contract represents the mean value that the market assigns to the outcome.

- Spread betting: In this format, traders differentiate themselves by bidding on the cutoff that determines whether an event occurs, such as whether a candidate receives more than a certain percentage of the popular vote. When spread betting is combined with an even-money bet, the outcome can yield the market’s expectation of the median outcome, because this is only a fair bet if a payoff is as likely to occur as not.

Market mechanisms: Markets can be organised as continuous double auctions (like stock exchanges), automated market makers (which algorithmically set prices based on order flow), or parimutuel systems (where all bets are placed in a pool and divided among winners).

Information aggregation: The price discovery process is driven by traders who believe they have better information than what is currently reflected in market prices. As Hayek (1945) famously argued, markets can efficiently aggregate widely dispersed information that no single individual possesses in totality.

Incentives for accuracy: Traders are incentivised to provide accurate forecasts because they profit when they buy (sell) contracts that are underpriced (overpriced) relative to the true probability.

The theoretical underpinning for prediction markets comes from efficient market hypothesis. In an efficient market, prices reflect all available information, making it difficult to consistently profit through trading. However, the possibility of profit provides the incentive for information discovery and revelation, leading to more accurate prices.

24.3 Parallels with other financial markets

Prediction markets share important similarities with traditional financial markets, though with differences in purpose and structure. Understanding these parallels can help clarify how prediction markets function and their potential value in corporate settings.

24.3.1 Stock markets vs. prediction markets

Stock markets and prediction markets both aggregate information through price mechanisms, but differ in several important ways:

Purpose: Stock markets primarily serve to allocate capital to companies and enable investors to share in future profits. Prediction markets exist specifically to forecast discrete events.

Fundamental value: Stock prices theoretically reflect the present value of future cash flows. Prediction market prices reflect the probability of specific events occurring.

Time horizon: Stocks theoretically exist in perpetuity, while prediction market contracts have specific expiration dates when they resolve.

Despite these differences, both markets serve as information aggregation mechanisms.

Wolfers and Zitzewitz (2004) note that prediction markets can potentially address some limitations of traditional financial markets. For instance, they can be designed to forecast specific events of organisational interest that aren’t tradable in conventional markets, such as project completion dates or sales targets.

24.3.2 Futures markets vs. prediction markets

Futures markets bear a stronger resemblance to prediction markets:

Contract structure: Both use contracts with specific expiration dates and conditions for payment.

Price discovery: Both provide price discovery for future states - commodity prices in futures markets and event probabilities in prediction markets.

Hedging: Futures markets allow producers and consumers to hedge price risk. Prediction markets can theoretically allow organisations to hedge against uncertain events, albeit that is not their central role (Wolfers and Zitzewitz, 2006).

Commodity futures prices, like prediction market prices, theoretically represent market expectations of future values. Roll (1984) demonstrated how orange juice futures prices efficiently incorporated weather forecasts, often predicting Florida weather better than meteorological forecasts themselves - a clear parallel to prediction markets’ forecasting ability.

24.4 Evidence on prediction market accuracy

Research has generally shown prediction markets to be effective forecasting tools, often outperforming alternative methods:

J. E. Berg et al. (2008) examined the Iowa Electronic Markets’ predictions of U.S. presidential election outcomes and found they outperformed professional polling organisations 74% of the time.

Cowgill and Zitzewitz (2015) analysed Google’s internal prediction markets, finding they produced more accurate forecasts than experts about company-specific events like product launch dates and business metrics.

The effectiveness of prediction markets appears to depend on several factors, including sufficient market liquidity, engaged participants with diverse information, and well-defined questions with clear resolution criteria.

One important point, discussed by Manski (2006), is that the market price is not always a direct measure of probability. Price is a function of the joint distribution of the traders’ beliefs, their budget constraints and their risk preferences. While the track record of prediction market accuracy suggest this is not an empirical concern in most prediction markets, there is theoretical ground for caution.

24.5 Behavioural biases in prediction markets

While prediction markets have demonstrated impressive accuracy, they are not immune to the systematic biases that affect human reasoning and decision-making.

24.5.1 Probability misperception

There is substantial evidence in behavioural science that people misperceive probabilities. One manifestation of this is long-shot bias, whereby people overvalue small probabilities and undervalue near certainties. This phenomenon is well-established in horse racing markets, where bettors receive much lower returns for long-shot bets than for favourites. Wolfers and Zitzewitz (2004) noted the phenomena on the Tradesports platform, where prices for comparable options prices on the Chicago Mercantile exchange suggested unlikely outcomes were overpriced on Tradesports. This probability distortions align with prospect theory (Kahneman and Tversky, 1979), which posits that people overweight low-probability events and underweight high-probability events in their decision-making.

24.5.2 Optimism bias

Corporate prediction markets reveal significant optimism biases, particularly in forecasting internal outcomes. In the Google markets, Cowgill and Zitzewitz (2015) found that “the optimistic bias is strongest for markets on project completion.” This bias manifested in multiple ways:

Project completion optimism: Markets consistently overestimated the likelihood of projects being completed on time, especially when the forecasted events were under employees’ control.

Role-based optimism: “Insiders and their friends trade optimistically at Google,” reflecting either strategic motivations or genuine overconfidence in their team’s abilities.

Organisational experience effect: New hires were the most optimistic, suggesting initial miscalibration that diminishes with experience as employees learn organisational norms and realistic expectations.

The persistence of optimism bias has several potential explanations:

Strategic concerns about signalling confidence in one’s projects

Genuinely biased beliefs due to overconfidence (overestimation)

Psychological commitment to projects people are personally invested in

The “inside view”, where people focus on case-specific details rather than statistical base rates.

24.5.3 Partition dependence

“Partition dependence” is a cognitive bias that affects how people assign probabilities when a range of possible outcomes is divided into categories. In prediction markets, this refers to how the market organiser chooses to divide the possible range of outcomes into discrete bins or categories.

For example, imagine a prediction market forecasting a company’s quarterly sales:

One market might divide outcomes into ranges: $0-1M, $1-2M, $2-3M, $3-4M, $4M+

Another market might use different divisions: $0-1M, $2-4M, $4M+

Fox and Clemen (2005) and Sonnemann et al. (2013) found that how these outcome ranges are defined influences prices. Specifically, traders tend to unconsciously anchor on an equal distribution of probability across categories, pricing each outcome at approximately 1/N probability, where N is the number of possible outcomes.

This means if you divide a range into 5 categories, traders tend to bias toward assigning roughly 20% probability to each, while if you divide the same range into 3 categories, traders tend toward 33% per category, even when the underlying probability distribution should be the same regardless of how you divide the possibilities.

This bias matters significantly for prediction market design because it suggests organisers can inadvertently influence prices simply by how they structure the outcome categories, potentially reducing market accuracy.

Interestingly, Cowgill and Zitzewitz (2015) found evidence contradicting this effect in Google’s markets. They observed a pattern of prices biased away from 1/N, suggesting participants underappreciate the effort that was put into security design, or overreact to their own priors or new information.

24.5.4 Emotion

Prediction market prices can be influenced by traders’ emotional states and broader market sentiment. Cowgill and Zitzewitz (2015) documented that the optimistic bias exhibits ‘mood swings’, in that prediction market prices were more optimistic following recent increases. A 2% increase in Google’s stock price was associated with prediction market prices for securities tracking optimistic outcomes being priced 3 to 4 percentage points higher. These effects were temporary, as there was no association between the prediction market prices and stock returns from two days earlier.

24.5.5 Strategic biases

Beyond cognitive biases, prediction markets can be affected by strategic biases where traders intentionally distort their trading to achieve secondary goals:

Career concerns: Employees may trade to signal optimism about projects they’re associated with, particularly when their reputation is tied to project success. In the Google markets, Cowgill and Zitzewitz (2015) found that employees directly involved in projects systematically traded more optimistically than other employees.

Manipulation attempts: Traders might attempt to influence decision-making by manipulating prices, though Hanson (2006) argued that manipulation opportunities create incentives for informed traders to participate, potentially improving market efficiency. Strumpf and Rhode (2006) examined historical attempts to manipulate political betting markets and found limited long-term impact.

24.5.6 Implications for market design

Understanding behavioral biases has important implications for prediction market design:

Incentive structure: Awarding a prize to the best performing trader creates non-linear incentives, potentially distorting prices. Linear incentives can reduce distorting effects of risk preferences and probability misperception. Google used a raffle approach that created linear incentives in artificial currency, potentially mitigating some biases (Cowgill and Zitzewitz, 2015).

Market maker mechanisms: Automated market makers can reduce biases from thin markets, as they enable trading when there is no-one else available for the other side of a trade, but they may introduce biases toward initial prices. Ford and Firm X used logarithmic market scoring rules that facilitated trading in thin markets but potentially introduced initial price anchoring (Cowgill and Zitzewitz, 2015).

Education, experience and feedback: Providing traders with feedback on their performance and calibration could reduce biases over time. Cowgill and Zitzewitz (2015) observed that prediction markets get better with age. Partly, this was due to successful traders continuing to participating while unsuccessful ones exited. That newly hired employees were most optimistic also suggests the potential for learning.

Anonymity: Anonymous trading may reduce strategic biases related to career concerns, though this must be balanced against the benefits of accountability and the potential for reduced participation.

The corporate prediction markets studied by Cowgill and Zitzewitz (2015) demonstrate that despite these biases, well-designed prediction markets still outperform alternative forecasting methods. The key insight may be that prediction markets don’t need to be perfectly efficient to be useful. They just need to aggregate information better than the alternatives available to an organisation.

24.6 Corporate applications

Several companies have successfully implemented internal prediction markets, adapting their design to address the behavioural challenges discussed above:

Google operated internal prediction markets for product launches, hiring, and other business metrics. These markets involved thousands of employees forecasting hundreds of events, with participants receiving play money to trade (Cowgill and Zitzewitz, 2015).

Ford used prediction markets to forecast car sales, enabling more responsive production planning (Cowgill and Zitzewitz, 2015).

Hewlett-Packard implemented markets to forecast printer sales and other business metrics, finding they outperformed official forecasts 75% of the time (Chen and Plott, 2002).

Microsoft ran prediction markets for software development timelines, helping project managers identify potential delays earlier (H. Berg and Proebsting, 2012).

Intel used prediction markets to forecast demand for new products, allowing for better inventory management (Hopman, 2007).

These corporate prediction markets have been used to address several types of forecasting problems:

- Project management: Estimating completion dates for projects

- Sales forecasting: Predicting sales volumes for products or services

- Risk assessment: Identifying potential problems before they occur

- Innovation management: Predicting which new projects will succeed

- Strategic planning: Forecasting industry trends and competitive actions.

24.7 Challenges and limitations

Despite their theoretical appeal, prediction markets face several implementation challenges in corporate settings:

Regulatory constraints: In many jurisdictions, prediction markets face legal restrictions when real money is involved. While some markets have operated under regulatory exemptions, companies typically rely on play-money alternatives to avoid legal complications. Servan-Schreiber et al. (2004) suggest that play-money markets can perform as well as real-money markets when participants are properly incentivised, typically through recognition or small prizes.

Thin markets: For specialised questions within companies, there may not be enough participants to ensure market efficiency. However, Wolfers and Zitzewitz (2004) observed strong predictive performance even in markets with 20 to 60 people. Further, to address liquidity problems in thin markets, platforms have adopted automated market makers. These algorithmic approaches ensure that traders can always find a counterparty, even in markets with few participants.

Manipulation concerns: In small markets, strategic trading to influence outcomes rather than reveal information can be problematic. While theoretical work suggests manipulation should ultimately improve market accuracy by creating profit opportunities (Hanson, 2006), practical experience suggests manipulation remains a concern in thinly traded markets.

Selection effects: Prediction markets can suffer from self-selection problems where only certain types of employees participate. This may limit the diversity of information incorporated into market prices.

Limited focus: Prediction markets tend to develop primarily around questions with natural gambling appeal, such as sports and elections, rather than the questions most critical to organisational decision-making. Outcomes of interest are also often difficult to write into a contract, meaning proxies for the outcome of interest are used. To address the limited focus of prediction markets, Hanson (2007) proposed combinatorial markets that can handle conditional probabilities and complex scenarios. While theoretically promising, these approaches often face computational and usability challenges

Misaligned incentives: Employees may have career incentives not to trade against the consensus or reveal negative information about projects they’re associated with.

Implementation costs: Establishing and maintaining prediction markets requires resources, including platform development, question creation, market monitoring, and participant education. These costs must be weighed against potential information benefits.

For a perspective on the challenges with prediction markets, read Whitaker and Mazlish (2024).

24.8 Prediction markets in scientific research

Prediction markets offer one approach to addressing the ongoing replication and reproducibility crisis. The reproducibility of scientific findings has become a major concern across multiple disciplines, with studies suggesting that a significant proportion of published research results may not hold up.

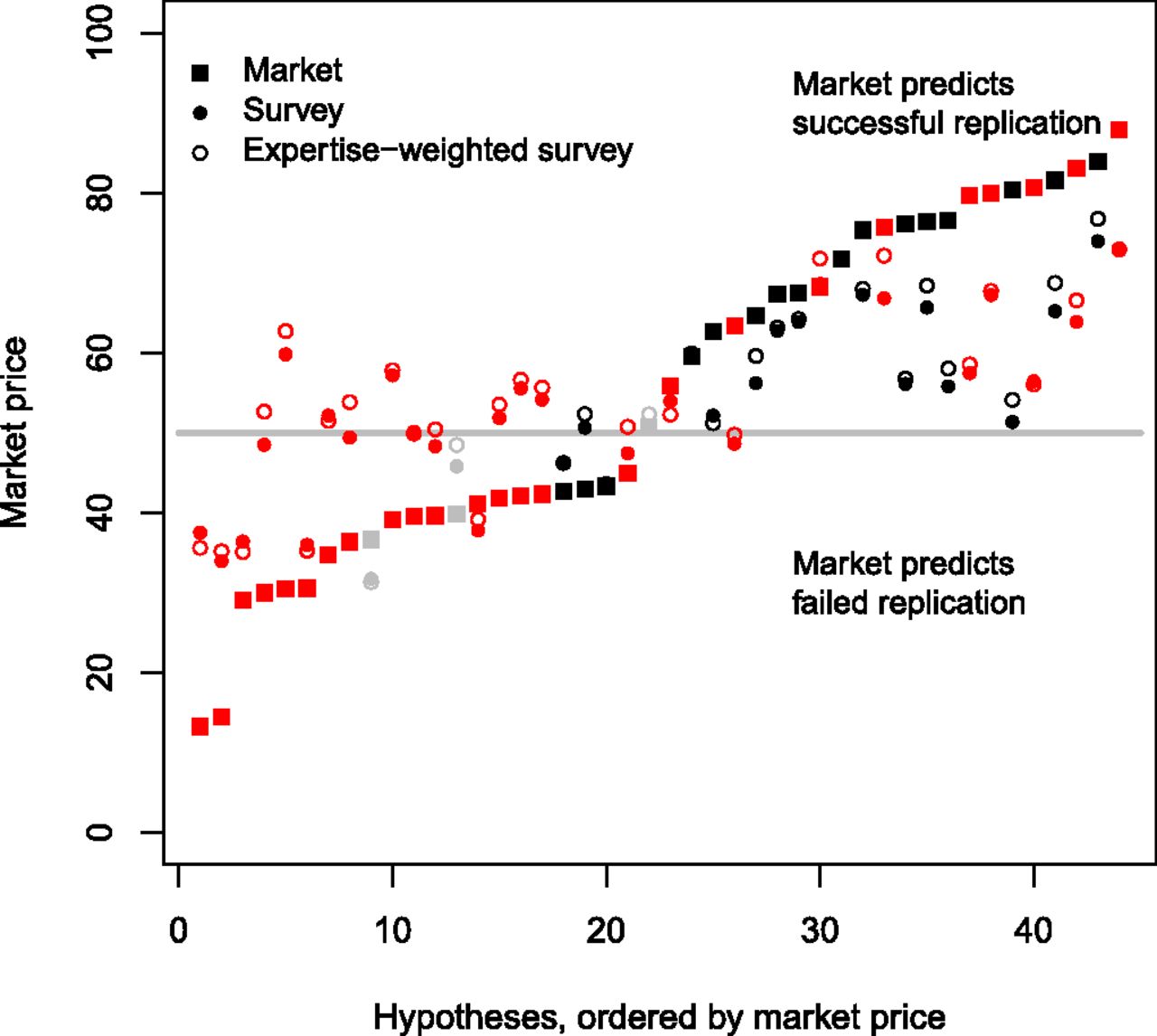

A study by Dreber et al. (2015) demonstrated the potential of prediction markets to assess scientific reproducibility. The researchers set up prediction markets around 44 studies published in top psychology journals that were part of the Reproducibility Project: Psychology. Participants could trade contracts predicting whether the original studies’ key findings would replicate when subjected to careful replication attempts.

The prediction markets correctly predicted the outcome of 71% of the replications, outperforming traditional survey methods of expert predictions.

These markets offer several potential benefits to scientific research:

Quick and cost-effective assessment of research reproducibility

Aggregation of distributed expert knowledge

A mechanism for prioritising which studies should be replicated

Since the Dreber et al. (2015) study, prediction markets have have found increasing application in scientific research. Platforms like Metaculus have developed sophisticated mechanisms for forecasting scientific and technological developments, allowing researchers to make probabilistic predictions about research breakthroughs, technological milestones, and emerging fields.

While still an emerging tool, prediction markets continue to demonstrate potential as a method for aggregating expert knowledge about scientific uncertainty. Researchers view these markets as a complementary approach to traditional peer review, offering a dynamic, crowd-sourced perspective on the likelihood of scientific discoveries and research outcomes.